Bluepill Express Exporting Quality Antimalarial Medicine Across Continents

This long-form article explains how Bluepill Express (hereafter “Bluepill Express”) positions itself as a trusted global supplier of antimalarial medicines: the medicines involved, quality standards, regulatory and documentary requirements for export, manufacturing and supply-chain best practices, pharmacovigilance and post-market support, market access and tendering, and practical guidance for international buyers and partners. Wherever I reference regulatory or technical standards I’ll point to the authoritative sources so importers, procurement teams, and partners can follow up directly.

Why reliable antimalarial supply matters

Malaria remains a major public-health threat across large parts of Africa, Asia and the Americas. Rapid access to effective, quality antimalarial medicines saves lives and reduces the burden on health systems — but only when those medicines meet global quality standards and are supplied consistently to the places that need them. Substandard or falsified antimalarials undermine treatment, accelerate drug resistance, and cost lives and resources. That’s the problem Bluepill Express aims to solve by exporting quality, compliant antimalarial generics to national programs, NGOs, clinics and private wholesalers across continents.

Key points:

- Effective antimalarial treatment typically uses artemisinin-based combination therapies (ACTs) for uncomplicated falciparum malaria; severe cases require parenteral artesunate followed by an ACT. WHO Apps+1

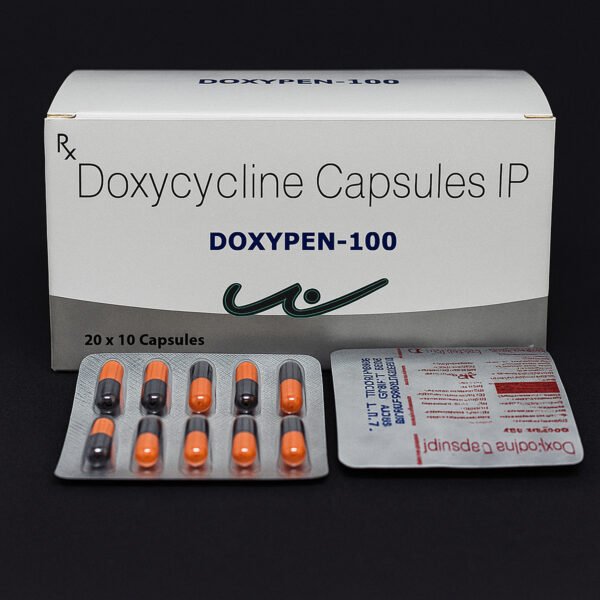

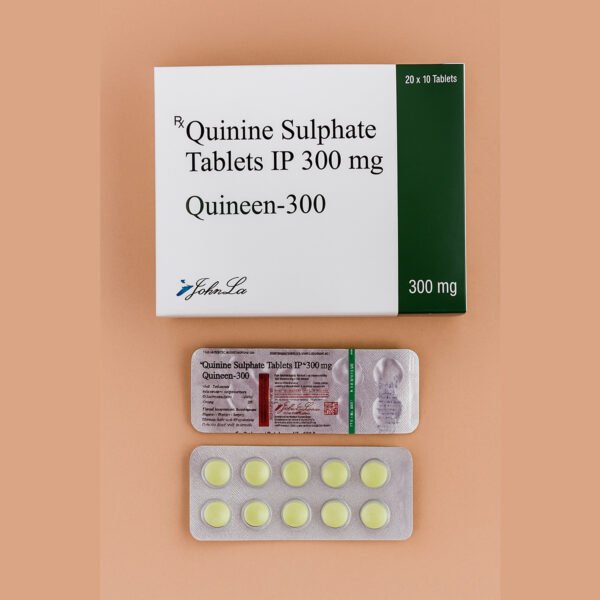

What “antimalarial medicines” we’re talking about

Most modern procurement focuses on two categories:

- Uncomplicated malaria — ACTs (artemisinin-based combination therapies)

Common ACTs include artemether–lumefantrine, artesunate–amodiaquine, artesunate–mefloquine and artesunate–sulfadoxine–pyrimethamine (though SP use is restricted in many settings). ACTs combine an artemisinin derivative (fast-acting) with a longer-acting partner drug to clear parasites and reduce resistance risk. WHO guidance and national treatment guidelines define first-line choices by region and resistance patterns. NCBI+1 - Severe malaria — injectable artesunate / artemether

Injectable artesunate is recommended for severe falciparum malaria and is followed by a complete oral ACT course once the patient can tolerate oral medication. WHO Apps

Other supportive products (rapid diagnostic tests, adjunct medicines for complications, pediatric formulations, etc.) often accompany antimalarial shipments but the main focus for pharmaceutical exporters is high-quality finished pharmaceutical products (FPPs): tablets, dispersible tablets for children, and injectables where required.

Quality first: WHO prequalification, GMP and independent testing

For medicines intended for public procurement or UN agency supply, WHO Prequalification (PQ) is the gold standard: manufacturers and finished products assessed through WHO’s prequalification processes gain global credibility for procurement. Bluepill Express sources products that either come from WHO-prequalified manufacturers or meet stringent GMP and regulatory standards for target markets. WHO Extranet

Good Manufacturing Practice (GMP) is non-negotiable. GMP ensures that production, testing and documentation follow defined procedures that minimize contamination, variation and errors. Buyers should demand certificates of GMP (or evidence of equivalent regulatory inspection) for any supplier of antimalarial finished products. World Health Organization+1

Additional quality controls commonly used:

- Batch release testing at accredited labs (assay, dissolution, sterility for injectables).

- Stability data demonstrating shelf-life under specified storage conditions.

- Certificates of Analysis (CoA) and retained sample programs for traceability.

Regulatory and export documentation — the checklist

Exporting pharmaceuticals is document-heavy and regulatorily sensitive. Bluepill Express supports buyers with a thorough set of export documents; below are the documents most often required by importing countries and customs authorities:

Core documents:

- Commercial / Pro Forma Invoice and Packing List (describe products, batch numbers, quantities, net/gross weights). Trade.gov

- Certificate of Pharmaceutical Product (CPP) in WHO format — often required by importing regulatory authorities to demonstrate legitimate manufacture and marketing authorization in the exporting country. U.S. Food and Drug Administration

- Good Manufacturing Practice (GMP) certificate or statement from a recognized regulatory authority. World Health Organization

- Certificate of Analysis (CoA) for each batch shipped.

- Certificate of Origin (validated by local chamber of commerce) — required by many customs authorities. Trade.gov

- Export license / No Objection Certificate (NOC) where required by the exporting country’s regulator — e.g., India’s CDSCO issues export NOCs for certain drugs and has published guidance on the process. If a drug isn’t approved domestically but is destined for export, specific NOC procedures apply. Bluepill Express assists with this paperwork when it acts as exporter. CDSCO+1

Other possible requirements:

- Import permits or registration evidence from the importing country (in many cases, the importer must hold a registration or a local license).

- Labelling and package inserts adapted to the importing country’s official language and legal requirements (labels must meet local regulatory requirements even if underlying composition is the same). CDSCO

Practical tip: start the regulatory dialogue early. Even a high-quality product can be delayed by missing import paperwork; proactive coordination between exporter, importer and regulatory authorities shortens time-to-delivery.

Sourcing strategy and supplier due diligence

Bluepill Express follows a strict supplier-selection framework to ensure safety and continuity:

- Prefer WHO-prequalified manufacturers or manufacturers with strong regulatory track records (US FDA inspected, EU GMP, stringent-regulator approvals). WHO Extranet+1

- Evaluate manufacturing site through documentation review: GMP certificates, past inspection reports, stability dossiers, CoAs and production capacities.

- Verify supply chain integrity: raw-material sourcing (APIs) traceability, secondary packaging vendors, cold-chain subcontractors (if applicable), and finished-goods warehousing practices.

- Contractual commitments for batch release, recall processes, and pharmacovigilance support.

Why it matters: failure at any upstream step (e.g., poor API quality) can create a batch of substandard medication. For antimalarials, that can mean treatment failure and pressure on drug efficacy in the community.

Packaging, storage and logistics

Antimalarial oral formulations generally do not require refrigeration, but correct conditions are essential for stability (temperature and humidity control). Key logistics practices:

- Temperature-controlled warehousing where required; desiccant and moisture-barrier primary packaging for stability in humid climates.

- FIFO and lot control to ensure older stock ships first and batch traceability remains intact.

- Robust cold-chain planning only for products that require it (most antimalarial oral tablets do not) — but injectables must be stored and transported per sterility and temperature guidelines.

- Secure transport partners with pharma experience; door-to-door tracking, tamper-evident seals and proof-of-delivery documentation.

Customs clearance and port handling: Bluepill Express works with experienced customs brokers to avoid delays caused by incomplete documentation — a common source of shipment rejection or quarantine.

Pricing, tenders and procurement channels

Bluepill Express serves multiple buyer types:

- Government tenders / national malaria control programs — require prequalification, bulk pricing and supply reliability. Competitive tendering often dominates this channel; suppliers must demonstrate capacity to deliver on time.

- UN agencies and global procurement mechanisms (e.g., Global Fund, UNICEF) — often require WHO-PQ or stringent regulatory approval for suppliers or products. WHO Extranet

- NGOs and humanitarian buyers — need flexible lot sizes, pediatric formulations, and quick response for emergency stockouts.

- Private wholesalers and hospital groups — operate on commercial terms but still expect compliant documentation.

Bluepill Express leverages long-term purchasing to offer competitive pricing while maintaining margin for compliance testing, batch release and supply-chain safeguards.

Pharmacovigilance and post-market responsibilities

Exporting medicines is not a one-off transaction. Bluepill Express maintains pharmacovigilance (PV) processes to collect, analyze and report adverse events when required by local regulations or contractual terms. PV components include:

- A local contact point for adverse event (AE) reporting and batch traceability.

- Systems to escalate serious adverse events to the originating manufacturer and, if necessary, to regulators.

- Rapid recall and withdrawal procedures when a batch is suspected to be defective or falsified.

These measures protect patients and buyers, and they are often contractual prerequisites in tender documents.

Managing risk: resistance, substandard products, and reputation

The twin threats to malaria control are parasite resistance and substandard/falsified medicines. Responsible exporters play a role in both:

- By supplying WHO-recommended, quality-assured ACTs they help maintain effective treatment options. WHO Apps

- By ensuring batch testing and documentation, they reduce the prevalence of substandard products in markets where regulation may be weaker.

- By supporting stewardship (education on correct dosing and completing courses) they help slow resistance selection pressures.

For Bluepill Express, reputation is a core asset. The company invests in quality assurance and compliance to avoid the reputational and legal costs of product failures.

Regulatory landscape example: exporting from India

India is a major exporter of generic medicines. Exporters there must be familiar with:

- CDSCO (Central Drugs Standard Control Organisation) rules: some exports require a No Objection Certificate (NOC) or special permissions for unapproved drugs destined for export. Guidance documents for export NOC and registration are published by CDSCO. CDSCO+1

- Evolving policies: in 2025 India signalled reforms to streamline export processes and consider export history in granting clearances — a measure intended to reduce administrative bottlenecks while maintaining safety. Exporters must watch regulatory updates closely. Reuters

If Bluepill Express sources from multiple jurisdictions, its regulatory team ensures exports comply with each manufacturing country’s rules as well as the importing country’s registration and labelling requirements.

Compliance beyond paperwork audits and ethical sourcing

Buyers increasingly require on-site or remote audits of manufacturing sites and supply chains. Bluepill Express supports audits by:

- Providing documentation packages (GMP, stability, CoAs, batch records) for review.

- Facilitating third-party testing and sample shipment for independent labs.

- Demonstrating ethical sourcing of APIs and excipients, and ensuring conflicts of interest or illegal sourcing are not present.

Ethics and transparency reduce the risk of supply interruptions and improve trust with buyers and regulators.

Case studies how the process looks in practice (hypothetical, illustrative)

Scenario A — A national malaria program in West Africa needs 500,000 treatments of artemether–lumefantrine (adult and pediatric formulations) within 60 days due to seasonal surge:

- Bluepill Express verifies product availability from a WHO-prequalified manufacturer, secures CoAs and GMP certificates, confirms batch stability for 12+ months, and begins export documentation (CPP, CoA, commercial invoice, packing list). WHO Extranet+1

- Customs broker and importer confirm local import permit; shipment consolidated with pharma-experienced forwarder for fast port-to-warehouse delivery.

Scenario B — An NGO requires injectable artesunate for a refugee camp:

- Bluepill Express confirms manufacturer sterility records and batch potency, arranges cold-chain/sterile handling if required, and provides PV contact and lot tracing. The company also provides clinical guidance documents for safe use and storage onsite.

These steps illustrate how quality, documentation and logistics must align to deliver medicines where they’re needed.

Practical guidance for buyers and partners

If you are a procurement officer, health ministry official, NGO logistics manager, or private importer evaluating Bluepill Express (or any new pharmaceutical supplier), check for:

- WHO PQ status or equivalent for the product or clear evidence of stringent-regulator approval. WHO Extranet

- GMP certificates and recent inspection reports for manufacturers. World Health Organization

- Complete export documentation (CPP, CoA, CoO, NOC where applicable). U.S. Food and Drug Administration+1

- Pharmacovigilance and recall procedures for rapid response.

- Logistics partners experienced in pharma handling and proof of secure transportation.

- Sample testing options: insist on independent third-party testing of initial lots if you’re deploying medicines at scale.

Ask for references from previous international buyers and, where possible, request a small pilot shipment to validate end-to-end processes before scaling.

The value proposition of Bluepill Express

Bluepill Express combines:

- Competitive access to quality generic antimalarials, often sourced from WHO-compliant or well-inspected manufacturers. BLUEPILL EXPRESS+1

- End-to-end export capabilities (documentation, customs brokerage, freight forwarders experienced in pharma). Trade.gov

- Regulatory support for NOCs and export compliance in origin countries such as India, including up-to-date guidance on CDSCO procedures. CDSCO+1

- Ongoing pharmacovigilance and batch traceability to protect patients and buyers.

This combination reduces procurement friction and helps ensure that antimalarial medicines arrive where they’re needed — safely, legally and on time.

Challenges and the road ahead

The pharmaceutical export environment is dynamic. Challenges include:

- Regulatory changes in exporting or importing countries (e.g., adjustments to NOC or export labelling rules). Exporters must remain adaptive to regulatory reform. Reuters

- Antimalarial resistance patterns, which can change treatment recommendations; suppliers must be ready to support alternative regimens if national guidelines shift. MMV+1

- Logistics and geopolitical risks (port delays, trade restrictions) that can affect timely delivery.

- Market pressures to reduce prices while maintaining quality — sustainable operations must balance cost and compliance.

Bluepill Express invests in regulatory intelligence, diversified sourcing, and robust quality systems to mitigate these risks.

Final recommendations for partners and buyers

- Prioritize quality and compliance over lowest price. The societal and clinical costs of substandard antimalarials are far higher than short-term savings. World Health Organization

- Require traceable documentation (CPP, GMP, CoA, CoO) and verify these with issuing authorities when possible. U.S. Food and Drug Administration+1

- Build long-term supplier relationships to secure preferential production slots, faster NOC processing (where origin regulators consider export history), and streamlined logistics. Recent regulatory moves aim to favour proven exporters. Reuters

- Insist on pharmacovigilance and recall provisions in the contract — these protect patients and reputations.

Closing summary

Delivering quality antimalarial medicines across continents is technically and regulatorily demanding. Bluepill Express positions itself as an experienced partner capable of meeting those demands: sourcing WHO-aligned ACTs and severe malaria therapies, maintaining GMP and batch control standards, managing export documentation and customs complexity, and supporting pharmacovigilance and post-market obligations. For governments, NGOs and commercial buyers, the priority must always be safe, effective and compliant medicines — and strong supply-chain partners are essential to achieving that.

IndiaMart

IndiaMart

FIEO

FIEO